Texas title loan customer reviews are crucial for understanding lending experiences, from positive cash access to negative interest rates and collections. These reviews guide borrowers but require scrutiny for authenticity. Key factors like vehicle valuation, keeping collateral, and repayment ease influence satisfaction. Authenticity is vital; be skeptical of aggregated testimonials, verify platforms, and seek balanced feedback to ensure accurate insights into Texas title loan providers' reputations.

Uncovering the accuracy of Texas title loan customer review ratings is essential for borrowers navigating this alternative lending landscape. This article dives into the intricacies of understanding these reviews, exploring factors influencing customer satisfaction and the reliability of online testimonials in Texas. By dissecting these elements, we aim to provide insights that empower informed borrowing decisions amidst a sea of varying opinions.

- Understanding Texas Title Loan Reviews

- Factors Influencing Customer Ratings

- The Reliability of Online Testimonials

Understanding Texas Title Loan Reviews

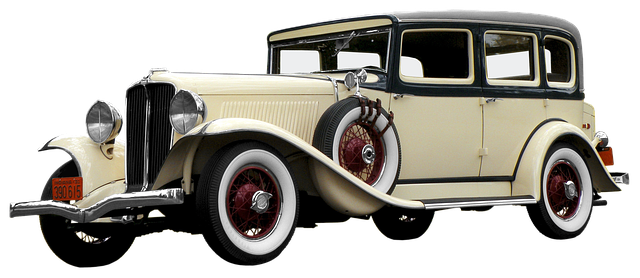

Texas title loan customer reviews are a critical aspect of understanding the lending industry within the state. These reviews offer insights into the experiences of borrowers who have availed of title loans, a form of secured lending that uses a vehicle’s title as collateral. Reviews can vary widely, ranging from positive experiences highlighting fast cash availability and flexible repayment terms to negative feedback about high-interest rates and aggressive collection practices.

In cities like San Antonio, where motorcycle title loans are popular, these reviews become even more significant. Borrowers often seek out honest assessments of lenders to make informed decisions. While some reviews may be biased or fraudulent, genuine customer feedback can expose problematic lending practices and help others navigate the market more safely. Understanding Texas title loan reviews is thus a key step in gauging the accuracy and reliability of various lending institutions, especially when seeking fast cash solutions.

Factors Influencing Customer Ratings

Texas Title Loan customer reviews are a valuable resource for borrowers looking to navigate the often complex world of short-term lending. However, understanding the factors influencing these ratings is crucial for interpreting their accuracy. Several elements play a significant role in how customers perceive and rate their experiences with title loan providers in Texas.

One key factor is the vehicle valuation process. Customers may base their reviews on how fairly their vehicles are assessed, especially since this directly impacts the loan amount they receive. Another aspect considered in customer ratings is whether they were able to keep their vehicle as collateral while taking out the loan, which can be a significant relief for many borrowers. Lastly, the ease and speed of the loan payoff process often leave a lasting impression, influencing satisfaction levels and review scores.

The Reliability of Online Testimonials

Online Title loan customer reviews Texas can provide valuable insights into a lender’s reputation and service quality. However, it’s essential to approach these testimonials with a critical eye, as not all reviews are created equal. Many websites aggregate user-generated content, which may include both genuine experiences and paid or manipulated reviews. To assess reliability, consider the platform’s transparency, verification methods, and a mix of positive and negative feedback.

When evaluating Title loan customer reviews Texas, look for patterns and consistent themes. Reputable lenders often have a diverse range of opinions, reflecting various borrower profiles and scenarios. The absence of extreme polarities—a few exceptional positives or negatives—can indicate authenticity. Additionally, checking for details like the date of posting and specific references to features like flexible payments or smooth title transfer (Financial Solution, Flexible Payments) can help filter out less credible reviews, ensuring you gather accurate information about a lender’s capabilities.

Texas title loan customer reviews are a vital tool for borrowers, but their accuracy depends on understanding the influencing factors. While online testimonials offer valuable insights, they can be subjective and manipulated. By recognizing the impact of individual experiences, financial situations, and lending practices, borrowers can navigate these reviews critically. Ultimately, a balanced view and direct communication with lenders are key to making informed decisions regarding Texas title loan customer ratings.