Texas Title Loan Lenders differentiate themselves through unique lending approaches and diverse clientele, with a consistent theme of swift approval processes in customer reviews. While some praise their flexibility and transparent terms, others express concerns about stringent credit checks and high-interest rates. Resident experiences underscore the importance of informed decision-making when seeking quick cash solutions via title loans in Texas.

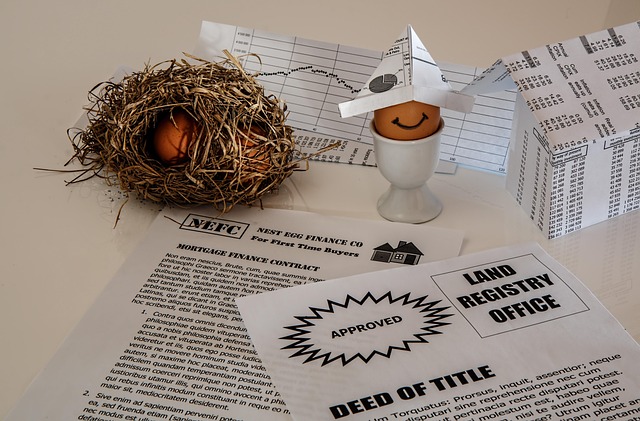

In the vibrant landscape of Texas, title loan lenders play a significant role in financial services. This article delves into the real stories and experiences of Texans regarding these lenders. We explore customer satisfaction levels and uncover the top concerns within the state. By navigating through various reviews, we provide insights into what Texans truly think about title loan lenders in their midst. Discover how these opinions shape the industry and inform borrowing decisions for those seeking financial solutions.

- Texas Title Loan Lenders: Real Stories Revealed

- Customer Satisfaction: Texas' Top Concerns

- Navigating Reviews: What Texans Say About These Lenders

Texas Title Loan Lenders: Real Stories Revealed

In the competitive landscape of financial services, Texas Title Loan Lenders stand out for their unique approach to lending, as evidenced by real customer reviews. These lenders cater to a diverse range of borrowers, from individuals seeking quick cash solutions to businesses requiring specialized financing, such as semi-truck loans. One consistent theme in title loan customer reviews Texas is the ease and speed of approval processes, making it an attractive option for those facing urgent financial needs.

Many real stories highlight the flexibility and understanding displayed by these lenders when it comes to meeting specific loan requirements. Customers have expressed satisfaction with the transparent terms and conditions, ensuring they understand the full scope of their loan agreements. This level of integrity in lending practices has fostered a sense of trust among borrowers, contributing to a positive reputation for Texas Title Loan Lenders in the market.

Customer Satisfaction: Texas' Top Concerns

Texas title loan customer reviews reveal a mix of experiences, with many highlighting the lender’s ability to provide quick financial solutions during emergencies. However, top concerns emerge, particularly around stringent credit check requirements and high-interest rates. These factors can make it challenging for borrowers to manage their debt, especially if they lack adequate emergency funds.

While some customers appreciate the accessibility of these loans, others express dissatisfaction with the overall cost and terms. The need for a reliable financial solution often outweighs these concerns, but it’s crucial for potential borrowers to understand the implications before taking out a title loan in Texas.

Navigating Reviews: What Texans Say About These Lenders

Texans, like anyone else, have a lot to say about their experiences with title loan lenders. When it comes to navigating the world of title loans, customer reviews play a crucial role in helping prospective borrowers make informed decisions. These reviews offer valuable insights into the reliability and transparency of these lenders, which are often sought for fast cash solutions.

Many Texans appreciate the convenience of title loan services, highlighting how they can quickly access funds using their vehicle ownership as collateral. However, others caution against high-interest rates and strict repayment terms. Some customers advocate for loan refinancing options to better manage their debt, while others stress the importance of understanding the full terms before signing. The diverse experiences reflect the complex nature of these loans, emphasizing the need for careful consideration and thorough research when seeking fast cash through title loan lenders in Texas.

Texas title loan customers share their experiences, highlighting both positive aspects and areas of concern. While some appreciate the accessibility and speed of these lenders, others lament high-interest rates and stringent repayment terms. Navigating these reviews is crucial for Texans considering a title loan, as understanding real-world perspectives can help them make informed decisions regarding their financial needs.